Deere Stock is Vulnerable

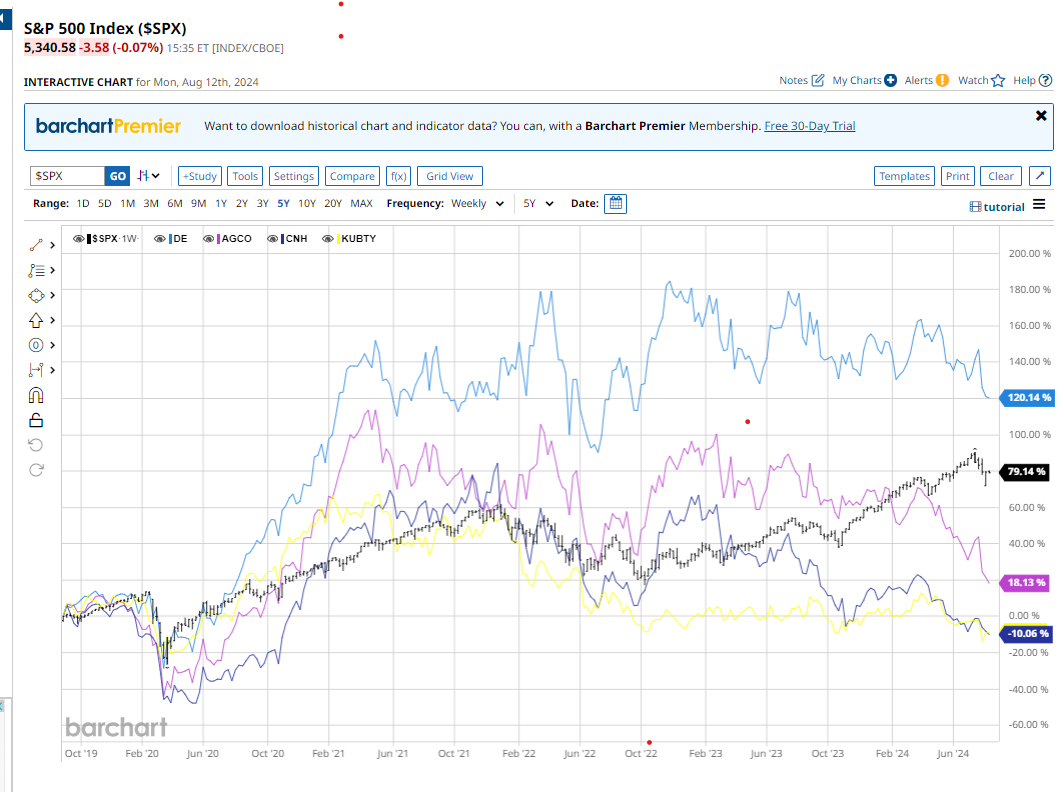

Since my January 31, 2024 blog post regarding Deere, Deere's stock price has fallen 11% (from $389/share to $345/share) as the S&P has advanced 10% (from 4,846 to 5,344). Despite Deere's 11% absolute decline and the negative 21% price performance differential from the S&P 500, I continue to believe that Deere stock has significant additional downside potential from current levels. What follows is an update from my January 31 post.

As farmers realized record profitability in 2021 and 2022 they used the excess profits and cash flow to upgrade their fleets. Exceptional end user demand combined with covid related supply chain contraints caused new and used equipment and replacement parts to be in extremely short supply. This allowed Deere and its dealers to extract very large price increases and drive large growth in margins. From its Oct 31, 2020 fiscal year to the latest twelve month period ending April 31, 2024, Deere's revenues grew by 65% and net income grew by 281%.

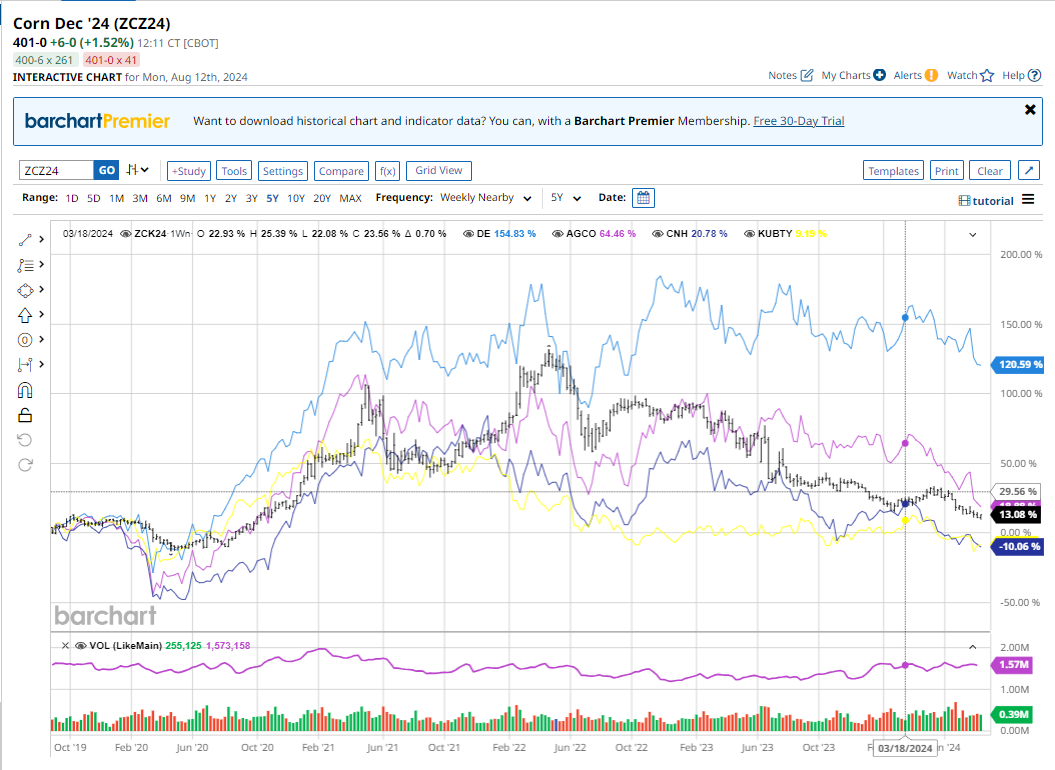

Now the tide has turned and enormous industry tailwinds have become very stiff headwinds. Corn and soybean prices have been in freefall since their peak in April 2022. Corn harvest futures have fallen by more than half from over $8.00/b to under $4.02/b while soybeans have fallen nearly 40% from $16.30/b to today's $9.88/b.

The chart below shows a 5-year picture of corn prices and soybean prices. Note the huge increase in prices that produced exceptional profitability for farmers for the 2021 and 2022 crop years. Today prices have returned into the lower historical price zone of 2019 and 2020, while farm input costs have increased by approximately 30% over that same period.

Farmers have very large fixed costs and relatively small changes in prices or yields have a very large impact on profitability. Based on a large survey of ag economists budgets, at current harvest prices and budgeted yields, farmers across the country will lose an average of $232/acre on corn and lose $138/acre on soybeans, taking into account all of their costs of production including land costs.

Given positive 2024 growing conditions, many farmers are anticipating higher than budgeted yields. However, even with a 5% outperformance in farm yields, farmer's would still face large losses of $200/acre for corn and $114/acre for beans.

Only a substantial price increase in prices would allow farmer's to achieve a breakeven result. The average farmer's breakeven futures price at budgeted yields is $5.47/bushel for corn and $12.76/bushel for soybeans. Futures prices would need to rise 36% from current levels for corn and rise 29% above current levels for soybeans to achieve breakeven.

A 5% beat on yields relative to the original farm budget would cause these breakevens to fall to $5.22/bushel for corn and $12.17/bushel for beans. In this scenario, futures prices would still need to rise 30% for corn and 23% for soybeans for the farmer to achieve breakeven.

This industry reset has not been lost on the Wall Street analysts. Analysts' estimates for Deere's next two quarters have been revised downward by approximately 20% over just the last 90 days. These estimates now project 40% year on year EPS declines for Deere for each of the next two quarters. Deere shares have reflected some modest weakness declining approximately 20% from their all time highs. Nevertheless, shares remain more than 150% above the price levels seen in Spring 2020, the start of the 2021 and 2022 boom years for the grain farming industry.

While the share prices of other industry participants have collapsed, Deere share price continues to levitate in the face of these industry headwinds. The following chart shows corn prices plotted against major ag equipment manufacturers Deere, AGCO, CNH and Kubota. While the other ag equipment manufacturers have largely tracked the decline in grain prices, Deere's share price (blue line) has so far shown remarkable resilience relative to the industry backdrop. Deere has taken significant steps to reduce costs and limit production in an effort to keep dealer inventories low and keep equipment prices high. Regardless of these proactive steps, in my opinion, the industry headwinds are simply too great to allow Deere's share price and earnings multiples to remain elevated relative to its competitors.

Farmers have literally stopped purchasing equipment and that reality will eventually be fully recognized by investors. If I prove to be correct, Deere's price has large downside risk from current levels. Deere is a very strong and innovative company and has a dominant industry position across many key product lines. Nevertheless, even those with virtual monopolistic industry positions are not immune to sharp sector declines.

The following chart shows Deere's performance relative to the S&P 500 and its ag equipment peers over the last five years. Over this timeframe, during the runup in grain prices, all of the ag equipment companies performed very well relative to the S&P 500. Since the turn in the grain markets, however, the ag equipment makers have largely given up their gains and returned to price levels of 5 years ago. Deere, by contrast remains 120% above its 2019 price, exceeding the exceptional 80% returns of the S&P 500 by nearly 40%.

One of the possible explanations for Deere's outperformance and premium multiple is its positioning as a technology company. Deere makes significant investments in R&D and continuously emphasizes this fact to its investor base. In recent presentations and on its website, Deere discusses its technology intiatives which include a litany of the hottest industry buzzwords including: artificial intelligence, the Internet of Things (IoT), cloud-based mobile applications, big data, drones, autonomous vehicles, and EVs/electric hybrids. Technology spending to transform its product portfolio is a constant theme from management -- whether or not these tech advances result in greater adoption or positive returns on investment for the farmer. As a stock, Deere has enjoyed this technology "glow" and been rewarded multiples far in excess of its more traditional ag equipment peers. It's foward P/E of 14.1x is at an approximate 50% premium to its peers which trade at an average forward P/E multiple of 9.4X.

In addition to managing its technology "story" to investors, Deere has also been very effective at managing Wall Street expectations such that it nearly always beats estimates. Deere guides to lower estimates and then proceeds to beat those lower expectations to create the appearance of outperformance. This could happen again in the upcoming quarterly earnings report. Their highly scripted and polished quarterly conference calls provide investors with a sense of security and confidence in management and the operations. But the reality of the sheer magnitude of the unit volume and price declines across the industry (regardless of technology spin and investor relations/PR), in my opinion, will eventually catch up to Deere. Any additional reductions in guidance or an earnings miss against already lowered expectations could take the stock down sharply to the $300/share range -- or perhaps well below that level depending on the extent of any revenue and earnings guidance reset. This would bring Deere much more into line with its industry peers and back down to earth -- facing up to the current harsh realities of the global ag equipment market. In my opinion, Deere's stock is vulnerable.

More Posts

- Deere Q1 Earnings Boosted 70c by One Time Items (Feb, 25)

- Ag Profit Decline and Possible Impact on Deere Shares (Jan, 24)

- Corn and Soybean 2024 Projected Losses (Jan, 24)

- 2024 ARC-CO PLC Decisions Using IFBT (Jan, 24)

- 2024 Cost of Production and Breakeven Harvest Prices (Dec, 23)

- Hiding in Plain Sight - Part 2 (Dec, 23)

- Hiding in Plain Sight (Dec, 23)

- Clearing out the Cobwebs (Nov, 23)

- From Joy to Despair (Nov, 23)