Ag Profit Decline and Possible Impact on Deere Shares

John Deere has been a great company over decades and has produced superior returns. It is a dominant agricultural equipment manufacturer in the US and globally. However, capital equipment purchases made by farmers are cyclical. Farmers tend to upgrade and expand their equipment when cash flows are strong. And when cash flows are weak, farmers pull back from large capital purchases.

2021 and 2022 were exceptionally profitable years for grain farmers across the US and the world. This exceptional profitability led to farmer spending to expand and upgrade their equipment fleets. Demand for new equipment was also pulled forward resulting from the fact that supply chain constraints limited the ability to find replacement parts for repairs, causing farmers to buy new equipment instead of repairing and maintaining their existing equipment. Used equipment pricing was also at a significant premium such that farmers trading in equipment could offset the total costs of new equipment with strong trade in pricing. Immediate expensing of capital equipment purchases for tax allowed farmers the ability to upgrade their fleets while also minimizing what would otherwise have been significant taxes on exceptionally strong farm income. All of these factors resulted in an acceleration in farmers’ normal equipment replacement cycles. The strong demand for new equipment allowed farm equipment manufacturers and dealers to charge substantial premium prices relative to prior years. Increased unit volumes combined with substantially higher prices drove large increases in both revenues and margins for the agricultural equipment manufacturers. These substantial increases in corporate earnings resulted in rapid and large increase in share prices.

In contrast to 2021 and 2022 crop years, the 2023 and 2024 crop years are projected to show an extraordinarily large and rapid reversal of excess farm profitability. For example, the profit per acre for the farm operator in central Illinois, after covering all operating costs including land rent, will fall from a PROFIT of approximately $250-$300 per acre in each of 2021 and 2022 crop years to a LOSS of $75-$125 per acre for the 2023 and 2024 crop years. Therefore, the typical 2,000 acre farm operation in central Illinois will generate a return for the operator equal to a profit of $1.1m over the 2021 and 2022 crop years. This same farm operator will face a loss of $400k over the 2023 and 2024 crop years. For the first time in nearly 20 years, the farmer will not generate adequate returns to cover their land rents.

Figure 1. Historical profitability for farm operators in Central IL

Source: https://farmdocdaily.illinois.edu/2024/01/revised-2024-crop-budgets.html

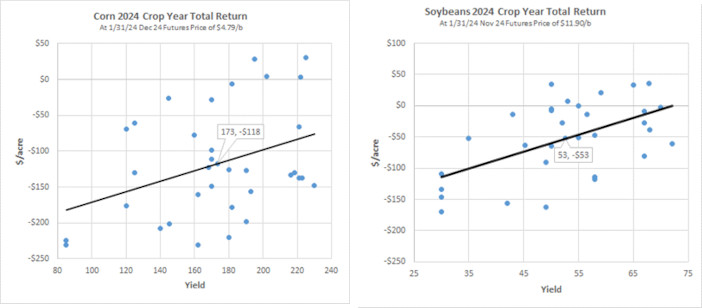

Figure 2 below shows the expected farm returns for corn and beans across the country based upon budgets produced by agricultural economists across 13 individual states and across a wide range of soil productivity and expected yields. The average expected operator return for corn is loss of $118 per acre and for soybeans is a loss of $53 per acre. Only a handful of budgets project profitability in 2024 and many budgets project significant losses for the operator at current prices and costs.

Figure 2. Scatter plot of budgeted profitbility for corn and soybeans for 2024

These much lower levels of farm profitability for 2023 and 2024, in my opinion, have not been fully reflected in farmer sentiment and purchasing patterns. Farmers are still living off of their strong equity and cash positions from the 2021 and 2022 crop years. However, they are now becoming acutely aware of much lower profitability and likely steep losses anticipated for 2023 and 2024 crop years.

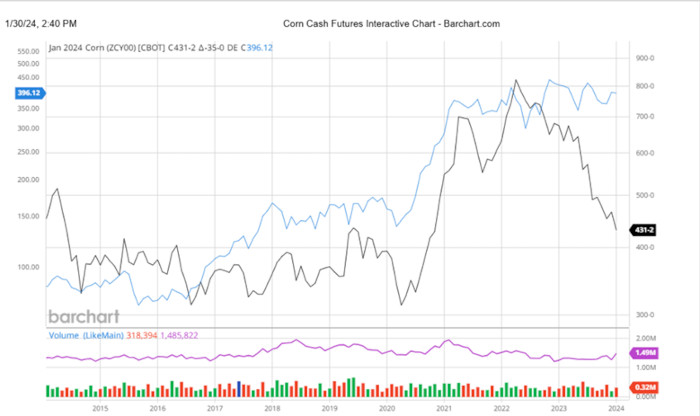

The chart below shows Deere’s stock price performance (blue) and corn prices (brown). Note the historical correlations between Deere’s share price movements and corn price movements.

Figure 3. Correlation between Deere share price and corn prices

At the far right of Figure 3 note the significant discorrelation between Deere stock (which remains only modestly below its all-time highs) and corn prices (which have fallen dramatically over the last 18 months). Despite the fact that farm economics have deteriorated very rapidly, Deere’s share price has not yet reacted to this significant decline in the profitability of its farmer customers both in the US and worldwide.

I believe, therefore, that Deere’s stock is highly vulnerable to both additional declines in unit sales and softening in equipment pricing, both of which will negatively impact revenues and profitability in coming years. Although some softening in demand and lower earnings are currently anticipated by Wall Street Analysts, I don’t believe that the extent of these potential future declines are yet reflected in Deere’s current share price.

On November 22, 2023, Deere reported very strong fiscal 2023 results for both revenue and earnings. Compared to the prior year, revenues were up 16% and EPS were up 49%. Much of the increase in both revenue and earnings was driven by substantial price increases realized during the year. For the final quarter of their fiscal year, however, revenue and earnings showed a marked deceleration from the prior year. Revenue growth for the fourth quarter turned negative to -1% and earnings growth was only 11%.

In their earning release and investor presentation, Deere indicated that operating profitability across their two key segments for their fourth quarter was negatively impacted by approximately 36% due to volumes and mix and that offsetting price increases of 40% caused operating profitability to rise slightly above the prior year’s levels.

For their fiscal year end release, Deere reported that 2023 actual EPS was $34.69/share. In their investor presentation, Deere also provided lower guidance to analysts for the 2024 fiscal year. Prior to Deere’s revised 2024 earnings guidance, analysts were expecting Deere to produce EPS of $32.92, representing a 5% decline from the strong 2023 year’s results. After incorporating the company’s revised guidance, analysts’ consensus EPS estimates for Deere fell by 14.2% to $28.23. Deere's EPS is now expected to decline 18.6% from the $34.69 reported in 2023 to $28.23 projected for 2024.

Following the release of the disappointing earnings guidance, Deere stock initially fell from $381/share to $358/share before subsequently rebounding to $393/share today. Prior to the change in guidance, Deere was trading at a forward PE multiple of 11.6x. The combined impact of the increase in Deere stock price and reduced earnings expectations for 2024 causes Deere's shares to now trade at a PE multiple of 13.9x 2024 projected earnings. Despite disappointing guidance and planned reductions in revenues and earnings, Deere's PE multiple expanded by 19.8% since their earnings release.

As the S&P 500 index led by large cap technology stocks has continued to rally over recent months, Deere's stock price followed suit. However, to the extent that the market were to retreat and some of the shine related to Deere’s positioning as an “ag tech”, “precision agriculture”, and “autonomous driving” company were to come off, I believe that Deere is highly vulnerable to PE multiple compression, particularly given anticipated year over year substantial declines in revenues and earnings for 2024.

If the agricultural equipment cycle plays out as I anticipate over the next 2-3 years, I think that Deere may also face larger than anticipated declines in unit sales and also suffer from a greater deterioration in pricing than is currently built into analysts earnings estimates. I believe that ag equipment volumes and prices were artificially inflated since 2021 due to supply chain shocks and the high demand relating to exceptional farm profitability. With the farm industry profitability rolling over to very large anticipated losses, I believe Deere has material downside risk to its share price. Any further reductions in guidance combined with any multiple contraction could have a substantial negative impact on Deere shares.

If I am correct, I believe that the stock could retreat and find support in the $300/share range. And if it were to break that level to the downside, $175/share would be the next support level where Deere was trading in early 2020. Deere's stock price exploded to the upside, including a 225% move since the start of 2020. If ag industry profitability does erode to the extent anticipated for 2023 and 2024, Deere's revenues, earnings and share price could face significant near term and long term headwinds.

More Posts

- Deere Q1 Earnings Boosted 70c by One Time Items (Feb, 25)

- Deere Stock is Vulnerable (Aug, 24)

- Corn and Soybean 2024 Projected Losses (Jan, 24)

- 2024 ARC-CO PLC Decisions Using IFBT (Jan, 24)

- 2024 Cost of Production and Breakeven Harvest Prices (Dec, 23)

- Hiding in Plain Sight - Part 2 (Dec, 23)

- Hiding in Plain Sight (Dec, 23)

- Clearing out the Cobwebs (Nov, 23)

- From Joy to Despair (Nov, 23)