Clearing out the Cobwebs

Cobweb Theory and Lessons From the 2023 Crop Year

Early look at 2024

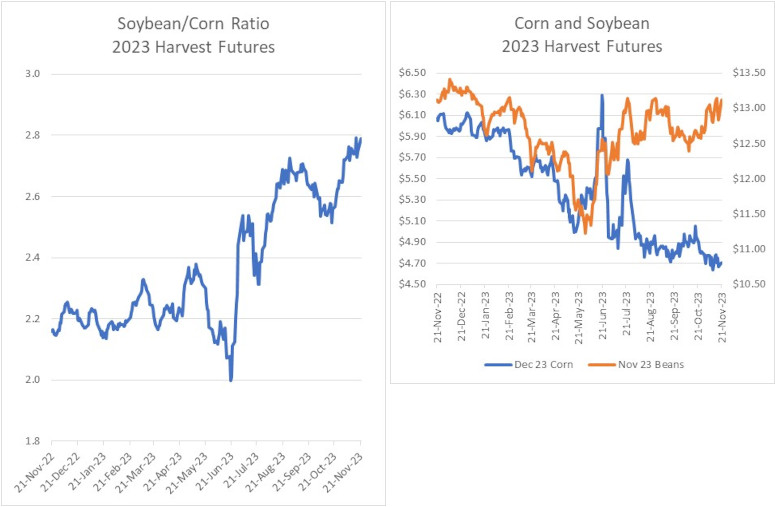

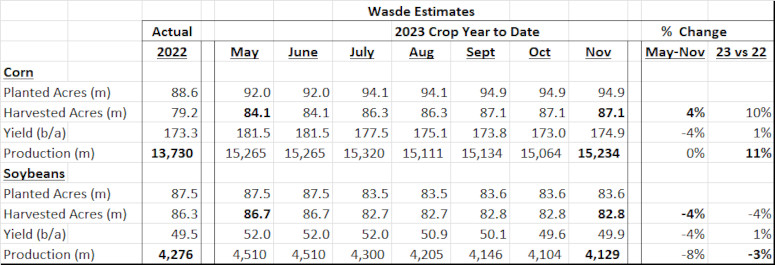

In the early stages of the 2023 crop year, the bean-corn ratio as shown in the chart below was approximately 2.2x. This was very low by historical standards. Both corn and soybean prices were elevated with 2023 harvest futures for corn above $6.00/bushel and soybeans above $13.00/bushel. Most producers were anticipating very attractive returns for both corn and soybeans at these attractive prices, albeit lower than the returns achieved in the 2021 and 2022 crop years. Relative to prior years, for many farmers, planting corn was expected to equal or be more attractive than planting beans.

The Cobweb Theory appears to have played out for the 2023 crop year. See the attached description at https://en.wikipedia.org/wiki/Cobweb_model.

The attractive expected returns for corn caused farmers to plant considerably more corn acres than were originally estimated and much fewer soybean acres. This combination of higher corn acres offset by modest yield reductions resulted in corn production exceeding the prior year by 11%. With far fewer acres combined with lower than anticipated yields, soybean production fell by 3% from the prior year. As the 2023 crop year planted acres, yields and production became known, prices for corn declined dramatically from $6.10 to the $4.70 range while soybeans recovered early losses to return to the $13.00 range. Note below the dramatic changes over the course of the 2023 crop year in expectations released by WASDE with corn harvested acres increasing by 3.0m from 84.1m to 87.1m and bean harvested acres declining by 3.9m acres from 86.7m to 82.8m.

A 4% increase in corn planted acres and a 4% decline in bean planted acres demonstrates that farmers responded vigorously to Spring price signals. While WASDE yield estimates declined by 4% for both corn and beans due to a less than perfect growing season, corn production was up 11% from the prior year as compared to down 3% for beans.

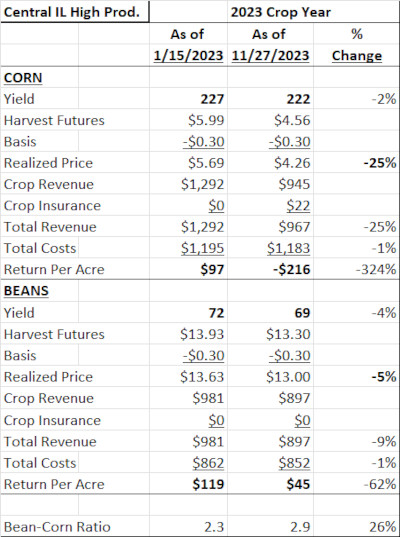

For our central IL farmer, U of I’s updated projected yields for corn fell from 227 to 222, or down by 2%. Beans yields fell from 72 to 69, or down by 4%. For the farmer that had not contracted grain prior to harvest, expected returns dropped precipitously. The corn yield shortfall combined with a 25% reduction in realized price, caused Corn profitability to drop from an initial expected profit of $97/acre to a loss of $216/acre (despite the farmer receiving a $22/acre corn crop insurance payment).

The soybean yield shortfall combined with a 5% reduction in realized price, caused soybean profitability to drop from $119/acre to $45/acre as shown in the table below. Farmers who chose not to market any grain early in the crop year to lock in reasonably attractive returns saw their anticipated profits for both corn and soybeans fall substantially from reasonably robust anticipated levels earlier in the crop year.

This describes a relatively extreme case of the farmer who chose not to contract ANY grain prior to harvest. Farmers who instead chose to lock some grain sales at the higher prices available earlier in the crop year had better performance. But the moral of the story is that understanding your costs and monitoring anticipated profitability is critical to establishing your marketing plan. A farmer looking at expected returns of near or greater than $100/acre for both corn and beans early in the crop year, in retrospect, would have been wise to have locked in pricing on at least a reasonable percentage of their anticipated production. Those returns would not have been as attractive as the 2021 and 2022 returns. And prices could have risen instead of fallen over the course of the crop year. But locking in a base level of profitability on a portion of the crop would have provided substantial downside protection while preserving upside opportunity if prices had risen instead of fallen.

Early Look at 2024 Crop Year

Profitability by Crop

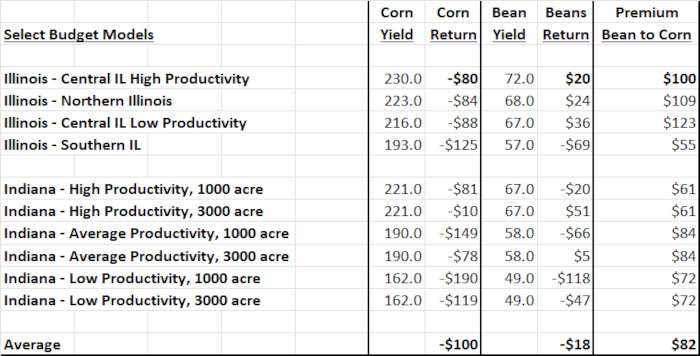

One might ask where do we stand as of today for the 2024 crop year? Unfortunately, as the graphic below demonstrates, currently there are limited opportunities for the farmer to lock in much anticipated profitability on corn and beans. Using the example of the same high productivity central IL farmer, as shown in the table below, that farm today would project losses of -$80/acre for corn and a profit of $20/acre for soybeans, taking into account all of the economic costs of production.

A summary of U of I and Purdue’s 2024 budgets updated as of 11/27/2023 for 2024 crop year harvest prices shows a range of anticipated profit outcomes for farmers with varying land productivity and farm sizes. On average, farmers in Illinois and Indiana would anticipate a $100 loss/acre on corn and a -$18 loss acre loss on beans. Beans are expected to outperform corn by $82/acre on average.

Budgets for IL produced by U of I are available at https://farmdoc.illinois.edu/handbook/2024-budgets-for-all-regions. Budgets for IN produced by Purdue are available at https://ag.purdue.edu/commercialag/home/resource/2023/09/2024-crop-cost-and-return-guide/

Despite price declines for certain major line items (especially fertilizer and fuel) many other costs are expected to continue to rise resulting in relatively modest overall cost reductions for the 2024 crop year for both corn and beans. A survey of a wide range of budgets released to date by 10 universities for the 2024 crop year for farmers with varying productivity and cost structures across the U.S. indicates that total cost of production (including land costs) is expected to be lower on average by about 7% for corn and is expected to be lower on average by about 1% for beans from 2023 levels. At current prices, using these anticipated costs, and assuming trend yields, soybeans will afford most farmers the opportunity to lock in near breakeven to modest profits today. Corn prices, however, are well below breakeven total economic cost of production for the majority of farmers across the country. Contracting corn for the 2024 crop at today’s prices and at assumed farm yields would be tantamount to locking in anticipated losses. That said, contracting some corn would also be hedging against the potential for any further price declines.

Crop Insurance

If harvest prices remain at current levels through the upcoming price discovery periods, crop insurance will provide much lower levels of protection for 2024 as compared to 2023. For farmers across the central grain belt, 2023 discovered Projected Price was $5.91/b for corn and $13.76/b for beans. At current harvest prices, discovered Projected Prices for the 2024 crop year would equal $5.04/b for corn and $12.80/b for beans. That would represent an $.87/b or 15% reduction for corn price guarantee, and a $.96 or 7% reduction for bean price guarantee. Therefore, without a meaningful recovery in 2024 harvest futures prices between now and the February price discovery period, the Projected Harvest price will provide a much lower price floor for farmers in 2024 than in the 2023 crop year. With current low prices and low anticipated profitability, farmers may find it difficult to swallow contracting any of the 2024 new crop grain, particularly corn. But it still may be their interest to hedge at least a portion of the crop. If price were to fall further over the 2024/25 crop year, the crop insurance price protection provided would be at levels considerably below breakeven. For example, an 85% RP policy, at today’s harvest prices, would provide revenue protection, assuming farm production at APH yields, of $4.28/b for corn and $10.88/b for beans. These price levels at which price protection would begin to trigger is FAR below the cost of production for nearly every corn and soybean farmer across the U.S. For example, using an average of the Illinois and Indiana farmers budgets, pushing through these low crop insurance guarantee prices would result in farm loss per acre of -$253/acre for corn and -$153/acre for beans before crop insurance price protection would begin to trigger.

Looking Ahead

In the prior discussion regarding the 2023 crop year and the apparent Cobweb Theory playing out, price signals induced farmers to plant much more corn than originally anticipated. Looking forward to 2024 crop year, one might reasonably anticipate that planted acres could swing strongly back in favor of soybeans and away from corn given the relative profitability of the two crops. Also, given that the 2023 crop year’s planted acres were so heavily skewed in favor of corn vs soybeans, a normal crop rotation would also tend to favor higher soybean planted acres for the 2024 crop year. This potential acreage shift based on current price signals, costs and relative profitability, and agronomical/crop rotation concerns could, over time, help change perceptions as to the expected size of the soybean and corn crops. A large increase in bean acres and reduction in corn acres in 2024 would help relieve the burdensome carry for corn and help alleviate the tight stocks-to-use projections for beans. Over time, this may help potentially bring bean/corn price ratios back down from still elevated levels.

Some of this potential acreage shift is undoubtedly already anticipated in the 2024 new crop harvest futures with soybean-corn ratio (just below 2.6x). This is considerably below the elevated levels for 2023 old crop harvest futures (near 2.8x). The 2024 levels are also much more in line with long term historical averages of around 2.5x. Nevertheless, if prices and costs remain at current levels, farmers will have a strong incentive to plant soybeans instead of corn in 2024 which could result in greater than anticipated bean production, lower corn production and a reversion to the mean resulting in a decline in the soybean-corn ratio.

Without any doubt, all grain markets are global in nature and heavily impacted by expectations for international production and demand. The size of the South American bean crop and the safrinha corn crop, ongoing war in Ukraine, macro-economic factors including the strength of the dollar and the health of the Chinese economy, all have substantial impacts on the U.S. grain markets. However, were there to be a large potential swing in planted acres towards beans and away from corn in 2024 (the opposing mirror image of 2023), that would likely have a meaningful impact on the relative prices in the U.S. of corn and beans. Hopefully for the farmer, any potential decline in the bean/corn ratio is the result of higher corn prices rather than lower bean prices.

On January 1, 2024, the IFBT application will release support for the 2024 crop year. This will allow the farmer to readily develop benchmark budgets and then customize them for their own operations. The IFBT application allows the farmer to test various assumptions around planted acres, crop insurance programs, title choices, grain marketing and other important factors to produce both a static budget as well as sensitivities to changes in farm yields and future prices. With this application, the farmer can readily estimate base case profitability as well as visualize the farm’s profit risk profile based on the risk management decisions that are implemented by the farmer. The application is available free for use at www.IFBT.farm

More Posts

- Deere Q1 Earnings Boosted 70c by One Time Items (Feb, 25)

- Deere Stock is Vulnerable (Aug, 24)

- Ag Profit Decline and Possible Impact on Deere Shares (Jan, 24)

- Corn and Soybean 2024 Projected Losses (Jan, 24)

- 2024 ARC-CO PLC Decisions Using IFBT (Jan, 24)

- 2024 Cost of Production and Breakeven Harvest Prices (Dec, 23)

- Hiding in Plain Sight - Part 2 (Dec, 23)

- Hiding in Plain Sight (Dec, 23)

- From Joy to Despair (Nov, 23)